the inevitability of crypto economy?

the inevitability of crypto economy?

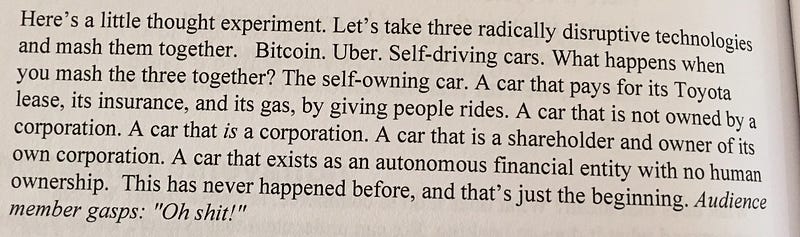

Once every few generations, we get to witness a milestone in human progress, a phenomenon or an icon so rare and inspiring that it defies extrapolation of the law of averages, and all known expectations of what is extra ordinary. At inflection points such as those, humanity makes progress by leaps and bounds. Standards are re-set. Recall the invention / discovery of electricity, spacecraft, electro magnetism, antibiotics, Einstein, the smart phone, Usian Bolt, Nicola Tesla.. they inspire awe, stretch our boundaries, expand the human experience, and alter the way we live – forever!

Our generation has been extremely privileged to witness more than a few such rare occurrences. Internet, Smart Phone and now #Cryptocurrencies. It’s as if we have achieved more technological progress in the past few decades than we have in the past several centuries. Not to belittle the foundations our forefathers and the great adventurers built and have bequeathed to us, but it is natural with any tipping point where progress accelerates manifold after gathering critical mass.

While we have significantly leveraged the internet and miniature computing, past the hype and mass adoption, we are still at the cusp of a revolution with respect to cryptocurrencies, so my piece today will focus on what awaits us in #crypto #economy!

(If you are short of patience, skip and head straight to Blockchain India Summit 6 Dec 2016 in New Delhi and hear directly from Vitalik Buterin, Founder of ethereum)

Ladies and Gentlemen

I am going to spill some secrets tonite, and betray the parable of swiss secrecy, as one does on a high.

I am high on Switzerland!

You are probably tempted to think of some revelations of the personal kind, but the swiss mastery of money and time – “philarguria“, and “chronometry“/chronology“/”horology” the two biggest obsessions of mankind – that the Swiss have made industries of – is as fascinating. Not to mention the draw of great intellects and relativity theorists like Einstein and now the modern day cryptographers, to Switzerland. I have always held that pristine beauty and tranquility are conducive to attaining superior realms of thought and thereby pinnacles of creativity.

Which explains the lure of Himalayas for many a world changing icon like Steve Jobs, though I couldn’t tell if Satoshi was as inspired by Switzerland as Vitalik. Anyway, if I were not Indian I would make it my home. Why, I have spent my most inspired moments here. Like when I was Vitalik’s age, I had taken my first ever international flight on Swissair to Zurich, and had been awe-struck by the experience seeing the gigantic imposing wooden doors of UBS for the first time. Years later I had returned to do my first ever investment banking deal – Hirslanden – for UBS. Years later I am about to do my first ever crypto stuff in Zurich again. So Switzerland is associated with deeply profound experiences, some romantic.

I am going to argue in this piece for the inevitability of cryptocurrencies. Cryptocurrencies are to modern economics as the theory of relativity is to physics.

Let us first visit the basics of money:

What is Money?

A form of promise – a promise to buy something of value

A substitute for direct barter – instead of exchanging my sheep for your wheat bushels, I give you money

A trust in a central party (like a Central Bank) that the currency note you carry will be worth some real value

A form of exchange – you give me your services or time and I pay you money

A factor in wealth creation, like labour – capital earns interest or can create wealth for its owner – capitalist economics

Money as an investment / appreciating asset (like art or Gold)

Let us for the time being ignore other philosophical definitions such as

Money as freedom to pursue life’s lofty goals

Money as a presumed substitute for immortality (a delusion of the rich that the more money they have the safer they will be)

Money has been serving its various functions well since the babylonian times, and yet has evolved with each successive generation. In earlier centuries, for example, artists would create art for their masters in return for their patronage and being taken care of, and not money. But slowly, transactions have come to be more short termish than a kingly patronage and have had to rely on money for settling the exchange of value. So the modern day Emir of Dubai or Oman would give his humble vassals wads of cash or write a cheque instead of promising his life long patronage.

The origin of cryptocurrencies

The concept of crypto money took life in 1997, when Nick Szabo invented hashcash. If anyone knows who Nick Szabo is, I am very keen to meet, if only to ascertain if he is Satoshi, and if he ever sent me a few emails. I discarded the possibility out of fear of being proved gullible by a fake Satoshi, and never took up my email “Satoshi” on the offer! As a solace, the rest of the world also knows Satoshi only by email! 😛

#Bitcoin was the first real form of crypto money as opposed to digital cash – for example Paypal. Ofcourse Facebook money, QQ coins, and coins in virtual games all made their remarkable debuts but these fancy coins were seen mostly as a means for the wealthy (chinese?) to splurge on the ridiculous and the inconsequential, besides robot cafes offering forbidden pleasures, you know what I mean. None of the currencies went so far as to be treated a substitute for real money. Facebook even applied for a banking license in Ireland wanting to capitalise on FB messenger being a platform for peer-to-peer cross-border payments (these constitute a significant chunk of global remittances market of US1 trillion a day as per BIS).

Bitcoin was the first money to solve the problem of trust in a trustless environment – The Byzantine Generals Problem – How can parties transact and establish trust, in face of non-verifiability and when all parties cannot be trusted. As all masterpieces go, Satoshi had combined together several disparate concepts in creating bitcoin. Obviously he had to have deep mastery of all subjects to come up with this invention, which has been fascinating technocrats as well as the cult of wall street.

Bitcoin has been a preferred mode of investment for some people, from every strata, including some retirees who chose to put their entire nest egg in bitcoin. One of the early bitcoin believers had told his friend – you will either lose all of it, or make a fortune like 1000X. Invest as much as you can stomach the loss! Interestingly, Satoshi himself had never spent a single bitcoin he had mined, as was discovered by an Eastern European developer who was tasked and paid to research this. And Satoshi had amassed bitcoin equivalent to millions of dollars as he had to keep the mining operation going singlehandedly, early on. Infact there were only two miners at the beginning for the better part of the first year, and the early months had just been Satoshi’s server. That he didn’t invent bitcoin for his own benefit speaks of his selfless movie in giving the world his open source gift. For anyone familiar with the mystical, this is self-evident – nature only bestows special gifts and privileges on people who would pass on their gift for the maximum benefit.

As it turns out, Bitcoin is also a form of protection against inflation for hyper inflationary countries, like any appreciating asset. One of the early bit coiners (Wences Casares, Founder of Xapo and Board member of Paypal) as a young boy would run into an Argentinian store with his family, grabbing all they could for the money his mom had just received in salary, so that they could maximise the value of goods purchased – in the face of hyperinflation. There was no concept of saving for tomorrow, because a few minutes later, the same notes would buy significantly less food as store keepers went around the aisles all the time rewriting price tags. Real story!

As a tribute to the genius of Satoshi, here is my attempt to decrypt his magic recipe of bitcoin.

Bitcoin is a cult!

Decentralisation – Satoshi’s first ingredient:

Satoshi essentially solved the problem of centralisation. A handful of people in the world got to decide how much money would be in circulation at any point (monetary policy), how much would its relative value be vis-a-vis other currencies, are people spending too much or too little and how to mend that (fiscal policy), how much would be the time value of money (interest rate), and what do people have to give up by way of data and privacy (endless KYC and identity verifications and intrusion into private affairs) in order to spend their money (yes you read it right – I didn’t say what people have to give up in order to earn money, but to spend money!)

If people could determine with zero error if money had indeed changed hands between parties and by how much, through #technology alone, without having to trust each other or any third party like a central record keeper, it frees people from the tyranny of watchful big brothers. And if I may add, greedy, power-hungry, self-aggrandising actors (if not dictators) on rotation – in the form of elected governments. Oligopolies who want to make money off your money spending transactions. With bitcoin, people can choose how and when they spend without a concern for informing anyone else about it – which many would agree “informing” amounts to slavery or extortion or restriction of liberty or all of the above.

The magic is that Satoshi achieves decentralisation through a mere technology protocol. A protocol that combines cryptography, mathematical functions, the economics of incentives in markets and game theory. There may have been bugs in code, as Satoshi himself encouraged other developers to fix and even go so far as to take ownership of the protocol but the code is essentially robust, and bitcoin code today contains supposedly only 15% of Satoshi’s original code.

Now experts are anticipating “segwit activation” on bitcoin code to happen in 2016, which will enable “Lightning Network” to speed up transactions on the original bitcoin #blockchain – whose 10 min Block interval had been a bottleneck for many, especially financial institutions. The earlier drawbacks of bitcoin – such as slow Block Verification – had been leveraged well by some firms such as Bitfury with their Lightning protocol and side chains. Bitcoin Blockchain is by far the most robust Blockchain, having been tested, bug-exposed, and reengineered by fervent believers espousing the cause of decentralisation. Bitcoin is no longer a currency or a technology, it is a cult! With Lightning embedded on top, the current Bitcoin Blockchain will give a tough fight to many fledgling and newer well-funded blockchains. Afterall, Cult figures are difficult to dethrone, no matter how nimble and powerful the imitators. Satoshi Nakamoto is a cult, and so is bitcoin!

I am not speaking yet about the blockchain or its benefits of faster, cheaper, frictionless transactions upending intermediaries in every industry, and am restricting my arguments only to bitcoin so far. See more bitcoin drama here. Read my piece on blockchain herehttps://www.linkedin.com/pulse/besotted-blockchain-arifa-khan and the sequel here

Cryptography – Satoshi’s second ingredient:

Cryptography and trap-door functions involving prime numbers and factoring, were applied to device public and private keys – a combination of which would enable you to unlock a bitcoin but make it impossible for you to reverse engineer a private key from a public key – thereby ensuring safety and irreversibility of a bitcoin transaction.

Game Theory – Satoshi’s third ingredient:

Since the mining operation is computational and energy intensive, what if some miner or a mining group amassed enough power to subvert the process to his benefit – aka the 51% hash attacks? Satoshi figured that for a serious miner playing for long term stakes, it is important that bitcoin’s value is sustained through confidence of the market and players. Any attempt by a player to abuse the process will result in bitcoin losing value, which would not benefit the rogue miners in long run. Ofcourse many hackers got away with blackmail ransoms from founders like Stephanie Kent who were blindsided by attacks on their chains. But those outcomes for hackers were not the Game theory Maxima, and the Nash equilibrium of bitcoin in long term does point to a sustainable bitcoin economy and thereby, an appreciating bitcoin – as has been proven by bitcoin price charts.

Macroeconomics – Satoshi’s fourth ingredient:

Satoshi foresaw that for the hashing to go on indefinitely, miners had to be incentivised by rewards (bitcoin) for carrying out the computational processing. He also took into account demand-supply dynamics of hashing power, and accommodated in his code self-adjusting difficulty level of computations required for arriving at the winning hash so as to keep the time interval between blocks a constant ~ 10 minutes. As he had anticipated, the early community actively engaged in upgrading the code, discovering and fixing bugs as it was open source – bootstrap nodes were introduced as an example to defend against DDOS attacks, and rogue miners hijacking the wrong fork of the blockchain.

Smart Contracts as a way of Record-Keeping— Satoshi’s futuristic fifth ingredient:

Satoshi had apparently studied money so thoroughly that he wanted to accord bitcoin the features of money as a tool for record keeping too, besides as a token of value or means of transfer. In Babylonian times, contracts were recorded on clay tablets as to how much one owed the other and when.

(Image of ‘A tablet from the Babylonian times’ – Prof Willi Brammertz Author of Unified Financial Analysis explaining Financial Contracts to me)

The complex hieroglyphics are thought to be the first form of record-keeping or accounting. To store 1MB of data in Babyloninan times would have taken a warehouse of several football fields and to transfer this data would perhaps take a ship physically ferrying these clay tablets across distances. The contracts were just a record, and depended on the good nature of the contractual parties or the fearsomeness of a central authority for execution. Satoshi now conceptualised a foundation for contract which depended on neither the goodwill or generosity of the counter party nor the authority of an intermediary to execute. The contract, with its collateral of cryptomoney in escrow, would irreversibly tilt the outflow of the underlying asset from one party to another, based on the outcome of a pre-determined function. Prof Willi demonstrated to me that all financial contracts currently in existence in the world can be explained by just some 30 patterns – so very amenable to Smart Contracts.

He visualised that this protocol would enable self-executing financial contracts to be embedded in code, and thereby obviate many other forms of centralisation such as the legal profession, notaries, securities exchanges etc. However, he was content to leave bitcoin code simplistic, in order to achieve more code robustness – to withstand any malafide attacks and bugs.

Disclaimer: I haven’t read Satoshi’s original paper. If I do, I hope to be able to decipher unspoken magic beyond Smart Contracts. If I go recluse, it would be because Satoshi will have sworn me to secrecy. 🙂

The history of Cryptocurrencies

Bitcoin is the world’s favourite #cryptocurrency, as a wide variety of players around the world have embraced it as an investment vehicle. It competes with real investments like real estate, gold, precious metals, art, jewelry, fiat currencies.

Hundreds of Remittance startups around the world have bitcoin rails supporting their FX remittance operations (buying and selling in the background which creates demand supply for bitcoin). 1000s of merchants in Africa and countries with hyper inflation or unstable currencies prefer to accept bitcoin over fiat.

Nearly 600 cryptocurrencies have been issued so far, since Satoshi gifted us the ‘bitcoin’ in 2009, and are now again back in the limelight. Zooko & Co have just launched Zcash (@zcashco) – a variation of bitcoin with absolute anonymity (no pseudonymity). The bitcoin price currently at $710 as of 30 Oct 2016 (having appreciated wildly in the past week with the hype around launch of new crypto “Zcash”) is expected to touch $1000 in 2017. Bitcoin has ridden the crests of human imagination at a scale never before witnessed, as one of the most fascinating man-made phenomenon of 21st Century. Bitcoin has survived drama of Shakespearean proportions. One investor who had put all his retirement savings in bitcoin early had lost it in one swoop when MtGox went belly up in 2014, losing a collective $400 million of its investors wallets in compromised security.

ZCash or ZEC works on a similar algorithm to bitcoin with the same 21 million ZECs to be issued during the lifetime etc, but 10% of which would be set aside and issued to stakeholders like founders, investors etc. Bitcoin was not entirely anonymous as its early adopters thought, as was proven by the anti-climax of Silk Road. Nor was ethereum’s DAO safer than a dozen #banks put together, as a hacker proved – resulting in the hard fork that split ether into ETH and ETC.

Many companies use cryptography in varying context. blockchain.info wallet only holds crypto files to encrypt and decrypt private keys and does not really hold the bitcoins in the wallet, thereby eluding regulation and also the licenses required for holding e-money. Nicolas Cary, CEO, is an oft quoted figure in bitcoin annals, a bundle of energy, and is a pleasure to listen to.

Now Zcash would be entirely anonymous. Enough to justify its futures trading price at 1.5BTC, when it hadn’t even begun trading? When it was launched, one report pegs the traded coin value at USD7000 , an eye-popping number given the highest bitcoin ever reached was ~ USD1000.

Cryptocurrencies – an inevitability of Modern Economics

You can now spend your crypto with absolutely no traceability. This would give the transaction finality of cash. You spend it and forget it – the original raison d’être of money. No need to maintain bills, accounting, or record the spend on a clunky blockchain. Take privacy back from the Governments, the Amazons, the Paypals, the Visas, Facebooks, Squares and Banks who horde all this data about your faintest digital trails and your minutest personal proclivities. Interesting anyone? You bet! It finally dawned on me why all the rich guys insist on spending only in cash everywhere. I am talking of respectable and responsible PE investors & the Valley kings, not just the flamboyant types.

Behold another variation at the opposite extreme of Zcash! A new coin wants to be the cryptocurrency with zero anonymity. You can always associate this coin with its owner’s identity. This is a play to serve the excessively cautious regulators and Central Bankers who would be loathe to give up on their KYCs and citizen accountability, much like Accenture wants to serve the Bank market who would love to get on a Blockchain lest they get taken over by Silicon Valley, but would be loathe to give up their control of data, and keep it mutable.

Then there are the architects of circular economies like the Solar coin, Diamond coin, Gold coin. Many firms are offering tokens/ coins at their ICOs such as Decent, Apptrade (Initial Coin Offerings are equivalents of IPOs in Crypto but no investment bank determines the subscription price). Apptrade is a stock market exchange for new DApps.

As eventful as my research goes, I met someone claiming to be the patent holder being infringed upon by – hold your breath – Apple, Samsung, and now Ethereum.. and he needed me as saviour to restore his rightful intellectual property and the billions (in dollars) to follow. Anyway, I happened to be in a conversation trois – at a swiss bar between the geek and Andreas Antonopoulos on patents & decentralisation. (I checked with another friend for a word for conversation between three – just so I wouldn’t accidentally mention the wrong menage and he goes “if you are part of the conversation, then its called “a monologue with two listeners“! hmm.. With friends like that, do I need detractors?) I caught Andreas, the author of “Internet of Money”, in a lighter moment in an impromptu conversation informelle and asked him why he thinks cryptocurrencies are inevitable. I quote him verbatim –

"The architecture of centralisation is antithetical to the principles and interest of society. Patents and any intellectual property is passe and will be outdone by open source as it is more conducive to innovation, and will garner more support as it is philanthropic. All my life, I have been against patents. This century is about decentralisation. So cryptocurrencies are here to stay!" Andreas Antonopoulos

Why will Crypto Currencies succeed?

- We are tired of paying fees, and customers will revolt when faced with superior customer friendly options

- We are tired of being surveillanced, and we will fiercely guard our privacy and interest when faced with more secure options

- Why do we have to supply onerous information when we decide to send or spend our own money? We tend to adopt the easier and more discreet options.

In a face-off between Wences Casares and Bill Gates, Wences had managed to convince an initially skeptical Gates that bitcoin was the tool for getting a bang out of his buck spent uplifting poor nations, and putting power back in the hands of the impoverished and unbanked. Bill Gates bought into that pitch. Alas, Wences just told me he can’t make it on 6 Dec to India – a favourite of every philanthropist trying to make a dent in the universe! Soon Wences!

Switzerland and its historic relationship with money (not a tryst)

Then there is the history of Switzerland as a storehouse of money. Even during the world wars, the wealthy chose Swiss underground caverns for preserving their wealth, as Switzerland has forever been a neutral peace-loving country more focused on being the world capital for banking, engineering precision, ultra luxury craft, hospitality, private schools and sanatoriums. Famous for its secrecy laws, the Swiss rarely concede to authorities as formidable as even the FBI. In keeping the tradition, The SBB (my favourite Swiss Bahn Railway) will be opening up its 1000 ticket kiosks as bitcoin ATMs on 11 Nov 2016.

Recognising Switzerland’s potential to emerge as the hub of crypto economy, Blockchain Storm hosted a roundtable discussion in Geneva on 30 Sep 2016 with authorities on distributed ledger technology such as Brian Behlendorf of Hyperledger, Bruce Pon of Bigchain, Eddy Travia of Coinsilium etc, which I moderated. We all agreed on the merits and the inevitability of crypto economy and that we now needed to work on interoperable systems and standards. So we will be gathering again in 2017.

Switzerland could emerge as a cauldron of unimagined combination of industries and academia – asset management, banking, crypto economy, precision engineering, luxury goods.

Many firms have made their home in crypto valley, Zug – perhaps for proximity to ethereum. Sample a bitcoin investment bank – “bitcoinsuisse”. If you wonder what CEO Niklas Nikolajsen looks like in real life, he had all the panache of a real investment banker spreading his fiat notes including a collectors’ item – A 100 SFR from centuries ago – on the table of a bar. How is that for a conversation starter? I remembered being in Copenhagen years ago on a deal, when my investment banking colleague Diamandakis had just given me a wad of cash and asked me to play at the Casino. I remember winning big at the tables that night, and feeling like Bond girl! And of course enjoying the high of a banker! We bankers are hopeless Adrenalin chasers! Years later, he was still surviving the credit crunch as a lone Director who held forth at Credit Suisse, long after many of his peers had ‘left’. Says something about human nature and the importance of making people happy as a secret of success in banking and elsewhere!

"Future of cryptocurrencies is bright. It's what we have been waiting for. The cheaper, faster, better system always wins. First came the internet which liberated data. Now comes Blockhain which will liberate value." - Niklas Nikolajsen, CEO bitcoinsuisse as told to Miss Khan

Caution : He could do this in Switzerland (display all forms of money old, new and crypto at a bar), but don’t try it elsewhere 😛

Now there are dozens of companies leveraging the swiss reputation as trust- keepers and managers of money. So much so that whenever a famous world leader dies or takes seriously ill, legends abound of their nearest kith and kith reaching first for their personal effects supposedly storing the password to their swiss account, before they consider anything else. So the Swiss had outdone Satoshi in private keys long before cryptocurrencies would become a global fashion? And they had combined it with their other passion for fine luxury crafted jewellery? Luxury Jewellery – a perfect draw for women, in turn a perfect draw for… Any Crypto Lord listening? 😛

Woman is the Oasis of Life!

Consider this tagline – Cryptocash – for cold bitcoin storage in swiss mountains. (I’d head there in a jiffy!)

The rise of Cryptarchs

Want to mint your own Cryptocurrency?

There are some things that cannot be cryptoed, but for everything else there is Batman. (Thank you MasterCard – your only legacy in a few years may be your clever advertising)

Input Output (IOHK) is a firm specialising in cryptocurrencies, ICOs and circular economies, the stuff where minting your own crypto is still a legitimate way to create wealth, and also to make yourself famous – while the fable of crypto is still an intriguing mystery. If you have an idea for another wildly successful crypto – consult with Batman in the guise of Charles Hoskinson, a fine mathematician, a person exuding eloquence on esoteric subjects, and great authority on all things crypto. We are pleased to be hosting him at our Blockchain Storm – Cryptocurrencies & Modern Economics – 20 January 2017 in collaboration with Swiss Finance Institute at University of Zurich.

All systems have been created by people no better and smarter than ourselves. We don’t have to accept them as fait accompli! –Charles Hoskinson

Charles, you can thank me later. But, where’s my crypto? 😛

IC3 – Initiative for Cryptocurrencies & Contracts

Lending cryptos their respectability is IC3 – an academic consortia led by Cornell University – which I was very privileged to receive an invite to join! Well, hobnobbing with academia has it’s benefits! Which brings me to our partnership with Swiss Finance Institute at University of Zurich, the university which employed Einstein as a Physics Professor in 1909. We are pleased to be hosting a “Cryptocurrencies & Modern Economics – Blockchain Storm Switzerland” event at Uni of Zurich on 20 Jan to bring together banks, academia and crypto economy stakeholders to take the debate to the next level. I chose Zurich, the world capital & Mecca of Banking as the destination for its concentration of intellect as well as assets under management, and for crypto valley – home of many game changers in open source protocols. Zurich is now interestingly the confluence of old money and new bleeding edge inventors. Be there at University of Zurich to herald 2017, the year that cryptocurrencies emerged as mainstream.

The legend of Vitalik Buterin

I am also playing hostess to India’s first ever Blockchain Summit http://europeindiaconclave.com, with the rare privilege of presenting Vitalik Buterin to India, alongside many distributed ledger technology firms from co-founders of Ethereum. India is eager to make the best of blockchain and welcomes Vitalik (read more about Vitalik in my Daily Pioneer article here). Zero Field Labs will be the bridge between Indian firms and Distributed Ledger Technology expertise in the west, and will also set up an Academic Excellence Centre on Blockchain in partnership with Indian Institute of Technology, my alma mater. We will also announce Blockchain Council India to work with the rule-makers on policy issues. I hope to have the regulator on stage for views on just what will be allowed and encouraged in India – given bitcoin is borderless and , by its very design, resists patrolling by powers-that-be.

I might consider giving a keynote on “India’s Climb to becoming an Economic Super-Power – What would I do as a Macro Economist”. I would be happy to host Senior Ministers at such a gathering, and hope the importance is not lost on rule-makers in the protocol maze.

Bitcoin is a mystery that never ends, wrapped in sequinned layers, beguiling a whole generation of crypto suitors.

The coming generations will remember the legend of Satoshi Nakamoto as a man who singlehandedly reduced a whole planet of rule makers to bedazzled spectators watching a real sci-fi thriller, with their hands tied. And being an object of Satoshi’s attentions (if not the object), however questionable the claim, gives me bragging rights 😛

You see, I have a rival in bitcoin!

About the Author

Miss Khan, the author, dedicated a significant chapter of her life, as investment banker executing Leveraged Buy-outs for Private Equity firms, at two bastions of swiss banking – UBS and Credit Suisse, after obtaining a MBA in Finance at Wharton Business School, University of Pennsylvania. Miss Khan is an avid blockchain researcher and speaker at various international forums such as Payments International. She advises Govt. of India on international financing. She has now identified her favourite destination Switzerland – as also a hub for people that will go down as legendary historic figures in the evolution of money – cryptocurrencies.

She lives in London. She paints for recharging, and photographs Switzerland. Meet her in New Delhi 6 Dec 2016 at http://europeindiaconclave.com with Vitalik , and in Zurich 20 Jan 2017 http://blockchainstormzurich.eventbrite.com with Charles Hoskinson. Follow her @misskhan

True to the spirit of sublimely Swiss, this piece was created on panoramic trains, charming rides on country roads, tete-a-tetes at chocolate places, tram rides to a quaint strasse where Einstein once lived, all soaking in excessive beauty of Switzerland. She marks this para as being penned on a very refreshing ride from Zurich to Luzerne which had turned rather chilly by nightfall on return.

Season’s Greetings

Happy Diwali

Miss Khan is CEO of Zero Field Labs, a crypto economy play.

the inevitability of crypto economy?

the inevitability of crypto economy?

Air

Air APIAX

APIAX Biz Gees

Biz Gees

Futurae

Futurae Lendity

Lendity SONECT

SONECT Traderion

Traderion Vesgoo

Vesgoo WealthInitiative

WealthInitiative

Reply